Spot Silver scales 1-month high of $33.70

Spot Silver rose to a fresh 1-month high of $33.70 per troy ounce on Thursday, as investor concerns over US fiscal outlook mounted, pressuring the US Dollar and driving demand for safe-haven metals.

The US Dollar Index was hovering above a 2-week trough, being last down 0.10% to 99.605.

A weaker dollar makes dollar-priced Silver more appealing to international investors holding other currencies.

Yesterday the US House of Representatives Rules Committee voted to advance President Trump’s sweeping tax-cut and spending bill, while a vote on the House floor is expected today.

At the same time, demand for a $16 billion sale of 20-year US Treasuries was tepid, as investors remained cautious after Moody’s lowered US’ top sovereign credit rating to Aa1. This indicated low appetite for US assets.

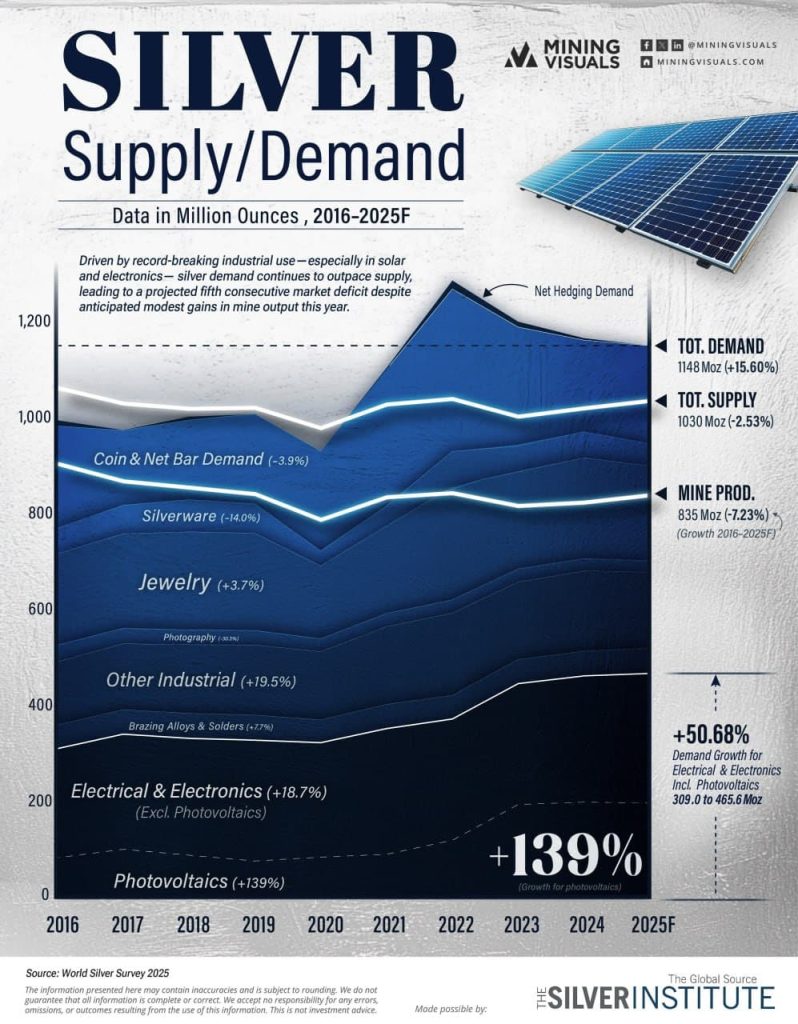

Meanwhile, industrial demand for Silver remained strong, especially from the solar energy sector. China’s wind and solar capacity rose to almost 1,500 GW in the first quarter of this year, the latest data showed.

Spot Silver was last down 0.27% on the day to trade at $33.30 per troy ounce.

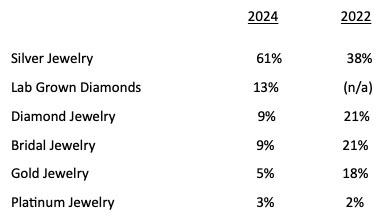

With global silver jewelry consumption on the rise, the Silver Institute commissioned a survey of U.S. jewelry retailers to gauge their view of the silver jewelry market in 2024. The results indicate that silver jewelry still holds a strong position as a leading merchandise category in the U.S. retail market. The survey showed that silver jewelry sales continued to deliver results for U.S. jewelry retailers, with 53% reporting marginally increased sales over the last survey, which studied the 2022 market.

Highlights from the survey include:

Silver experienced the best maintained margins for the Holiday Season:

- 71% of retailers said they increased their silver jewelry inventory in 2024 by an average of 15%. This represents a 10% growth over the last survey, at 61% in 2022.

- Retailers said their silver jewelry sales, as a percentage of their overall jewelry sales, averaged 31% of unit volume. In 2022, this category was 28%.

- The average store growth for silver jewelry sales was 20% in 2024, vs. 14% in 2022.

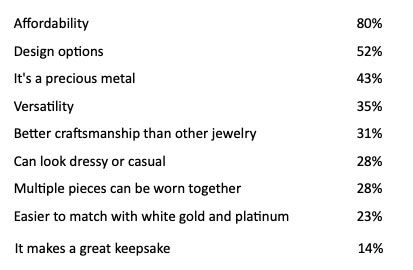

Most important reasons customers bought silver jewelry in 2024:

- According to the retailers surveyed, the age groups buying the most silver jewelry are 20-40, followed by 41-50. Female self-purchase is the best-selling opportunity for silver.

- 83% said silver jewelry is essential to their business. In 2022, this figure was 88%.

- 92% of retailers say they are optimistic that silver jewelry sales will continue to grow for the next several years. In 2022, it was 88%.

“Silver jewelry offers the consumer many options at a price point that is friendly to the wallet. Interest in big and bold silver jewelry with increasingly stylish designs is leading many consumers to choose silver jewelry,”

- Grain 9999°

- kolokotroni 9 athens greece

- BENEFICIARY: Refine M. IKE

- BANK: Attica Bank

- IBAN: GR0301602650000000085228609

- SWIFT CODE: ATTIGRAA